Offerings

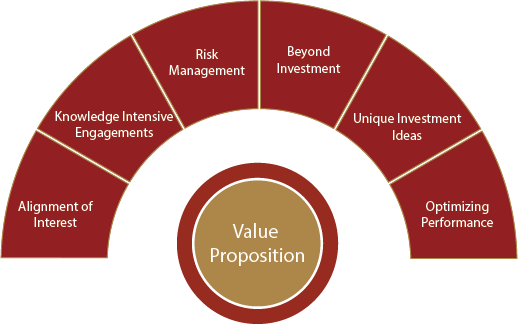

Value Proposition

We aim to be a trusted partner to our clients by providing unbiased and timely advice across financial and non-financial needs. The core essence of our approach lies in fulfilling the client’s investment needs.

Expert advice from market professionals

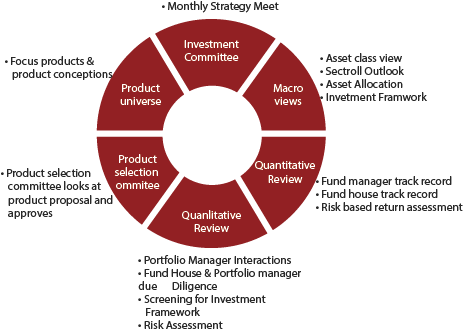

We leverage our domain expertise across the financial services spectrum. Our Investment Strategy Committee comprises of the most experienced personnel across our organization who are instrumental in defining our market view and guidelines on asset allocation. So, our customers can be assured of quality financial services.

Intensive product selection process

Since we are totally committed to providing our customers with a personalized experience, our endeavour is to ensure that our clients have a range of innovative solutions and unique products to choose from. All our products and services are from the best providers in the industry selected after undergoing our internal due diligence process.

Strong service platform

We understand that our customers value comfort of interaction and convenience above all else. Keeping in mind this, we have ensured that our customers are being serviced through a strong bench of experienced and trained Financial Advisors. We also have dedicated Equity Advisors who specialize in providing customers with direct equity solutions. Our offering of online and mobile execution platforms for equities and other products ensures that our customers have a seamless platform for all transactions while our Associate Executives ensure seamless service delivery.

Design Your Own Financial Space

At ICICI Securities Private Wealth Management, we believe in helping you creating a blue print for yourself basis your financial goals and your life stage. You can count on us to provide you with personalized service and solutions that are customized to meet your specific needs. Keeping in mind your need for diversity, convenience and comfort, we provide you with a dedicated Financial Advisor who will assess your financial objectives objectively before assisting you in creating your portfolio as per your instructions. You can be rest assured that you will be spoilt for choice. Like everything else in your life which is unique to your lifestyle, your financial space will also be unique to you.

Our investment advice will guide you in maintaining, generating and protecting your wealth across generations.

Investment Needs

Design your investment portfolio with the best in class investment products carefully selected to ensure diversification and the fact that they are specific to your growth needs:

- Equity solutions - research, broking and managed solutions

- Fixed income solutions - access to primary and secondary markets along with managed solutions*

- Alternate investment solutions*

- Offshore investments*

Business Needs

- Equity Capital

- Debt Syndication

- Mergers & Acquisitions

- Asset Monetisation

Value-added Services

- Protection solutions*

- Mortgages and loans*

- Legal services#

- Tax advisory services*

- *ICICI Securities acts as a distributor for these third party products

- #ICICI Securities refers business to partners for these products

At ICICI Securities Private Wealth Management, your financial decisions will be cushioned with the current and relevant market information for trading and long-term investing, which is provided by an independent research team which specialized in garnering the required inputs. In addition to this, your Relationship Managers will be available to analyse your investment needs from time to time in conjunction with you and create an investment roadmap for you. They will, after your acquiescence execute the investment plan.

A wide range of products across asset classes ensure that the financial solutions provided help meet the investment objectives that you have set for yourself and your family.

Capital Fund Raising/Investment Banking

Structured advice on raising capital from the Capital Market through IPO/ FPO and from the Institutional market through QIB and PE including advice on new accounting regulations (IFRS).

Estate Planning

Structured wealth distribution advice to create provisions for legal heirs and other beneficiaries through preparation and execution of Wills, setting up and management of Trusts.